Willie vs. The IRS: The $16 Million Mistake

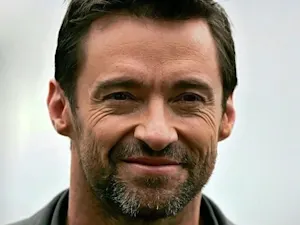

Willie Nelson May 2012. Photo by joshbg2k. Public domain.

You wouldn't expect a man with braids, a bandana, and a beat-up guitar named "Trigger" to go head-to-head with the most feared agency in America — but in 1990, Willie Nelson found himself staring down the IRS. And spoiler alert: the IRS won. At least at first. What followed was one of the wildest financial comebacks in entertainment history — part music, part hustle, part cautionary tale. And buried in all that twangy drama? A few seriously smart lessons about taxes, trusts, and planning for the unplanned.

The $32 Million Mistake

Let's rewind to 1990, when the IRS seized nearly everything Willie owned across six states — including recording equipment, awards, and even his wardrobe. Why? Back taxes. Lots of them. The IRS estimated his total tax debt at a jaw-dropping $32 million, although the final bill was later adjusted to $16.7 million, more than $10 million of which was interest and penalties, according to Rolling Stone.

So, how does a guy who's been cranking out hits since the 1950s end up in a mess like this? Two words: bad advice. Nelson claimed his accountants mishandled his money, funneling it into shady tax shelters. And like a lot of artists, he trusted the pros and kept making music. Until the IRS came knocking.

When the IRS Shows Up, They Don't Knock

On November 9, 1990, federal agents swooped in and seized Nelson's property. But not his beloved guitar, "Trigger." He saw the writing on the wall and sent it to his daughter in Hawaii for safekeeping.

He also reportedly stopped performing — temporarily — to prevent the IRS from collecting ticket revenue. But Willie being Willie, he didn't wallow. He brainstormed.

And then? He turned his tax bill into an album.

"They didn't bother me, they didn't come out and confiscate anything other than that first day, and they didn't show up at every gig and demand money. I appreciated that. And we teamed up and put out a record," Nelson said, according to Click2Houston.

The Album That Paid the IRS

In 1992, Nelson released "The IRS Tapes: Who'll Buy My Memories?" — a two-disc acoustic album recorded with just him and "Trigger." No studio bells or whistles. The goal was simple: sell 4 million copies and pay off his debt.

Spoiler: the album didn't exactly fly off the shelves — partly because the infomercial promoting it had the wrong phone number printed on Willie's T-shirt. Still, it raised around $3.6 million, and with a bit of creative deal-making, he eventually settled with the IRS for $9 million in 1993, Rolling Stone reported.

Nelson even poked fun at the saga a decade later, starring in an H&R Block® Super Bowl® ad slathered in shaving cream. If you're gonna lose millions, you might as well laugh about it.

What You Can Learn From Willie's Tax Debacle

This wasn't just a famous musician forgetting to file a 1040-EZ. This was about trust, planning — and what happens when both go sideways. Here's what the rest of us can take away:

1. If it sounds too good to be true, it probably is.

Nelson's advisors used complex tax shelters that were eventually disallowed by the IRS. If your financial strategy relies more on loopholes than logic, it may not stand up in an audit.

2. Trust is good — oversight is better.

Willie trusted his team. But trust doesn't replace due diligence. Whether it's taxes, estate planning, or investing, you need to know what's being done in your name — or at least have someone independent checking the work.

3. Don't underestimate the power of creative problem-solving.

Nelson didn't just sell assets and lawyer up — he made a record. A good one. He found a way to stay true to himself while solving a real problem. That's financial resilience with style.

4. Use trusts and estate planning to avoid chaos.

If Willie had placed some assets into a trust, more of his legacy could have been shielded. A trust can protect your home, your music, even your retirement fund — and it's not just for the rich. Think of it as insurance against both taxes and turmoil.

5. Always have a backup plan.

The IRS doesn't care how famous you are. Planning for the worst — whether it's a market crash, a lawsuit, or a massive tax bill — is what separates survivors from headlines.

The Last Laugh

Today, Willie Nelson is still touring, still recording, still smiling. He paid off the IRS. He kept his sense of humor. And most importantly, he got "Trigger" back.

As for the rest of us? We may not need to sell an album to pay our taxes — but we should probably double-check our returns, ask smarter questions, and consider putting a little something in a trust.

Because as Willie proved, even if you're a legend — the IRS doesn't miss.

References: Flashback: Willie Nelson Settles IRS Tax Debt | That time when Willie Nelson made an album just to pay his IRS debt